Population (12/2022): 9.656M

About IVC

Established in 1997, IVC is the leading data source and business information company in Israel's high-tech industry.

⏱ Avg. Reading Time: 3 min

Established in 1997, IVC is the leading data source and business information company in Israel's high-tech industry.

We provide the most comprehensive, accurate, updated data, research and insights on Israel’s tech ecosystem, startups, Private Equity and Venture Capital.

IVC addresses organizations of any sort which have interest in the innovative and fast-growing Israeli high-tech ecosystem. Among our clients: strategic & financial investors, foreign and local VC funds, Family offices, Angels, CVC, PE funds, Fund of Funds, Incubators & Accelerators, service providers, NGO’s, government entities, multinational corporations, academy, technology transfer companies, start-ups, research institutions, entrepreneurs and more.

Vision & Mission: The Israeli high-tech ecosystem becomes bigger and mature, IVC’s mission is to continue collecting and analyzing relevant data in order to provide our clients with the most accurate and in-depth information which assists them to formulate their scouting efforts, strategy and position in the Israeli market.

Tel Aviv is one of the greatest tech hubs in the world; it has the highest number of startups per capita in the globe and the highest investment of GDP in R&D

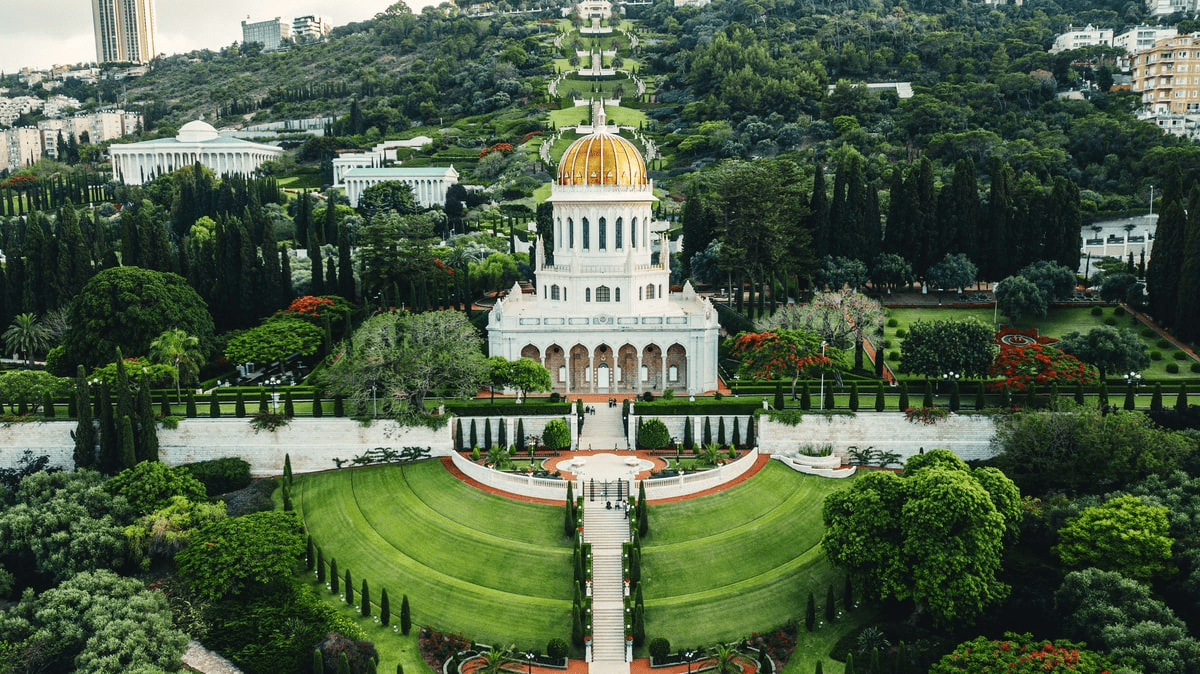

Haifa is an industrial zone and a tech hub. It hosts leading companies such as Microsoft, Intel and Google and academic institutes

In Herzliya high-tech park there are +360 startups and large companies, including Apple’s R&D center, and Microsoft

The city already has +400 active technology companies+

Foodtech, AgroTech, ii2020 – emphasize on periphery

Cyber Center - a joint venture of the Israeli National Cyber Bureau, Beer Sheva Municipality, Ben Gurion University and leading global companies in the cybersecurity industry

Tel Aviv is one of the greatest tech hubs in the world; it has the highest number of startups per capita in the globe and the highest investment of GDP in R&D

Haifa is an industrial zone and a tech hub. It hosts leading companies such as Microsoft, Intel and Google and academic institutes

In Herzliya high-tech park there are +360 startups and large companies, including Apple’s R&D center, and Microsoft

The city already has +400 active technology companies+

Foodtech, AgroTech, ii2020 – emphasize on periphery

Cyber Center - a joint venture of the Israeli National Cyber Bureau, Beer Sheva Municipality, Ben Gurion University and leading global companies in the cybersecurity industry

More than 7,619 Startups

$76,981m investments in Israeli tech companies

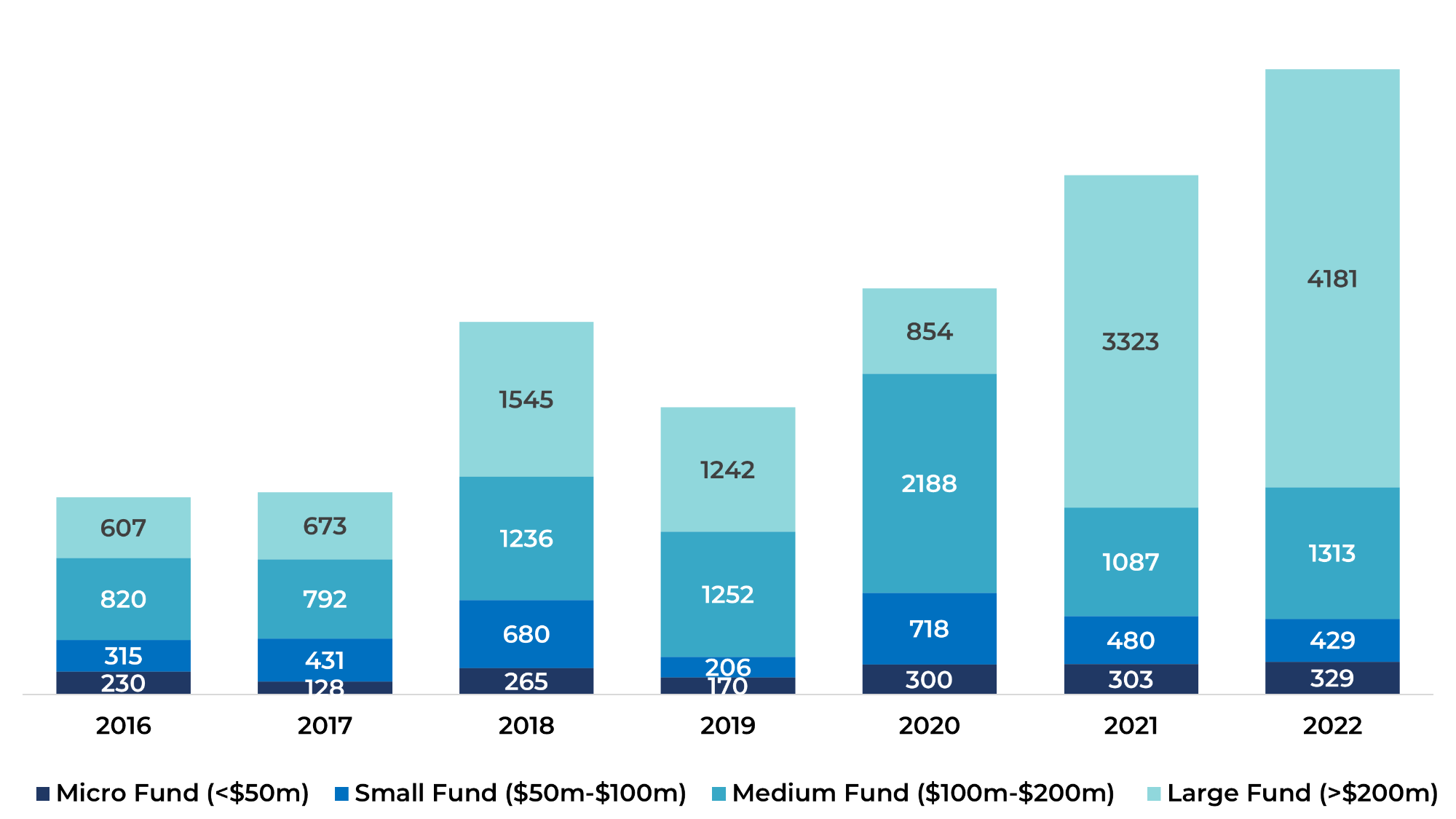

$25,433m were raised by 243 Israeli VC funds, mostly from foreign investors

Total Exits $6,097m (731 deals)

Total M&A’s $5,206m (614 deals)

Total IPOs $1,379m (117 deals)

66 listed in STOCK EXCHANGES

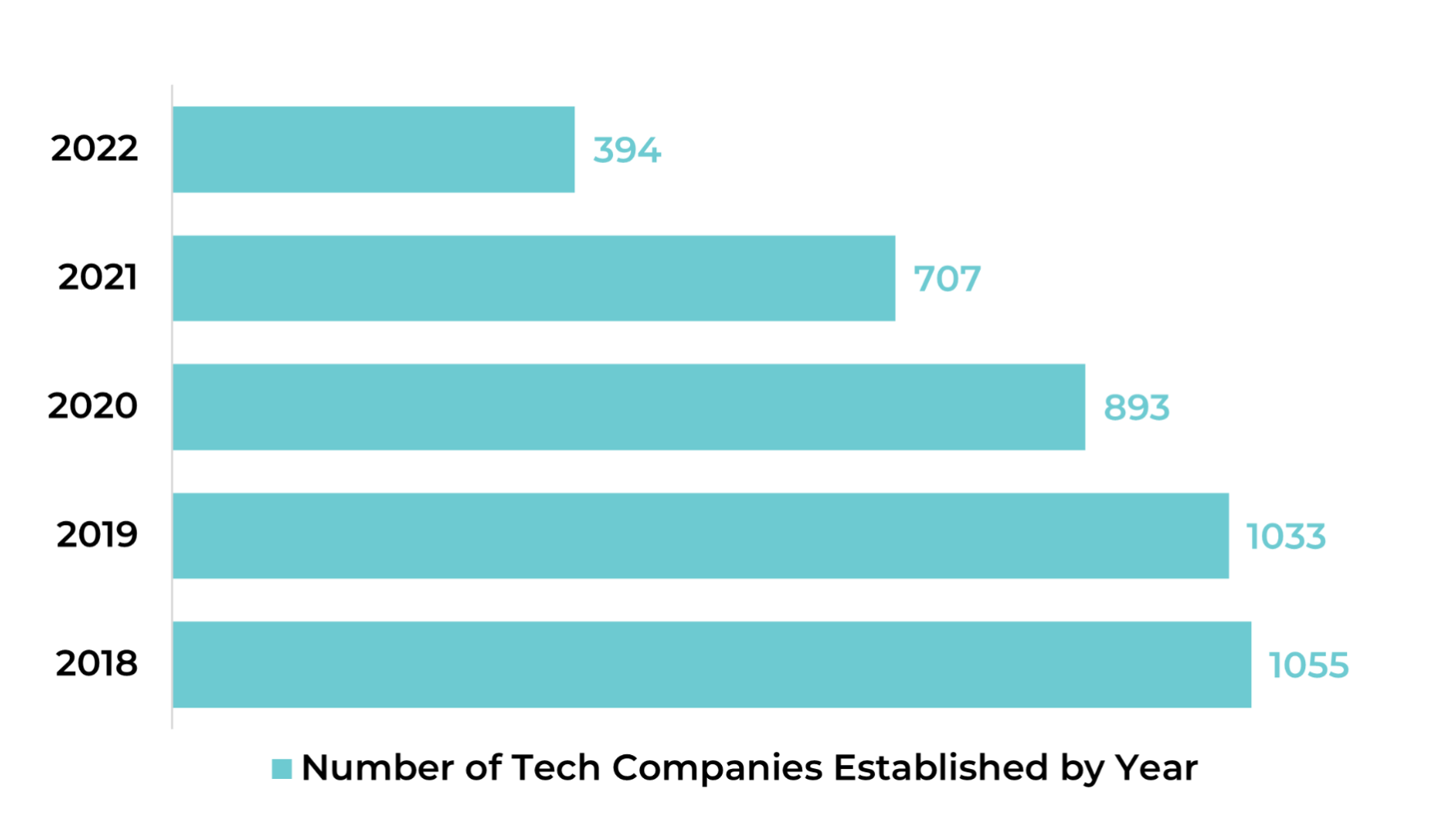

Israeli tech companies established between 2018-2022

Currently there are +9400 active tech companies on the IVC Database

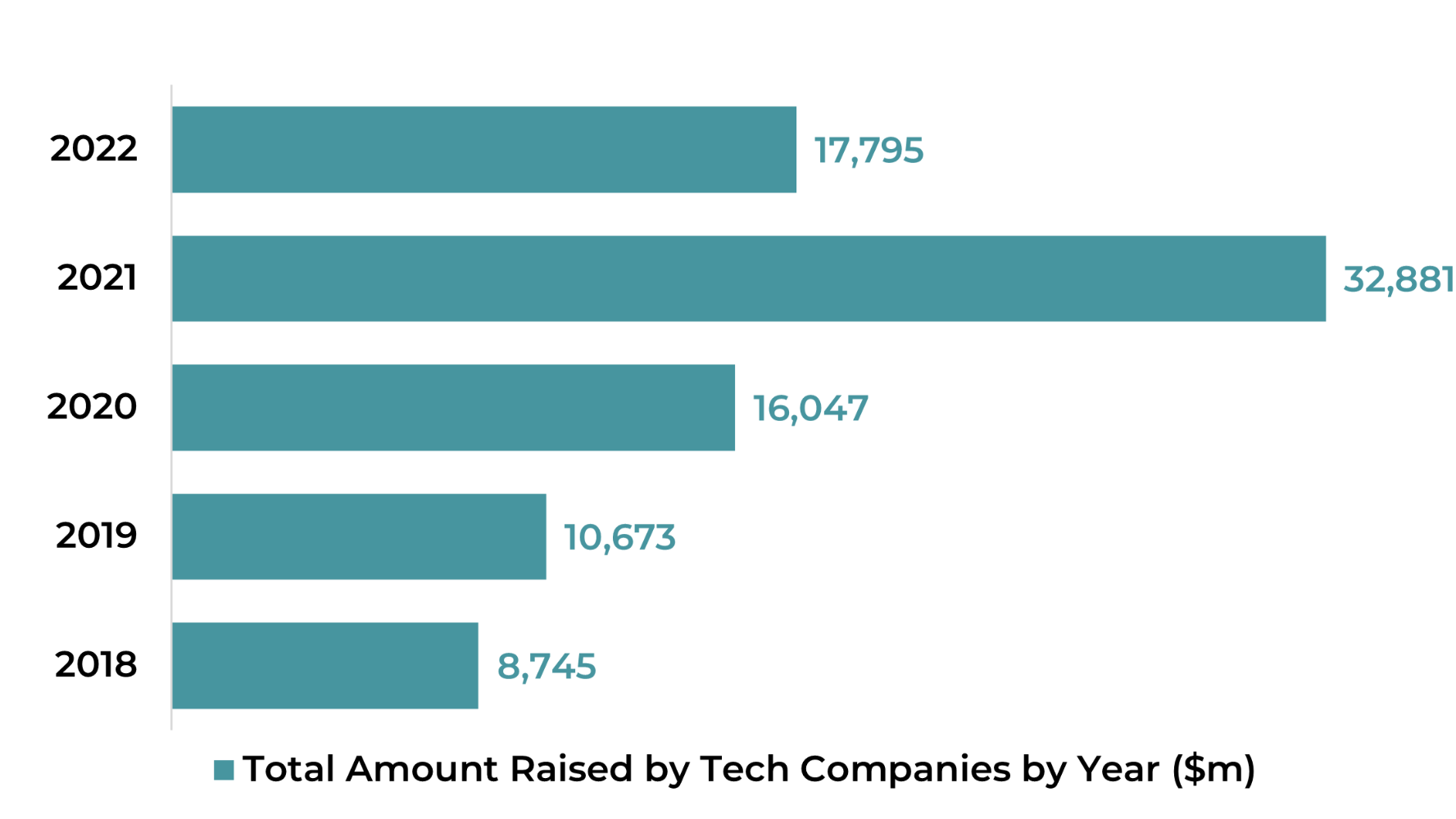

looking at Israeli tech investments between 2018-2022, There is a significant increase in the amount of money raised by the companies with a peak marked by 2021, after which 2022 shows a decrease.

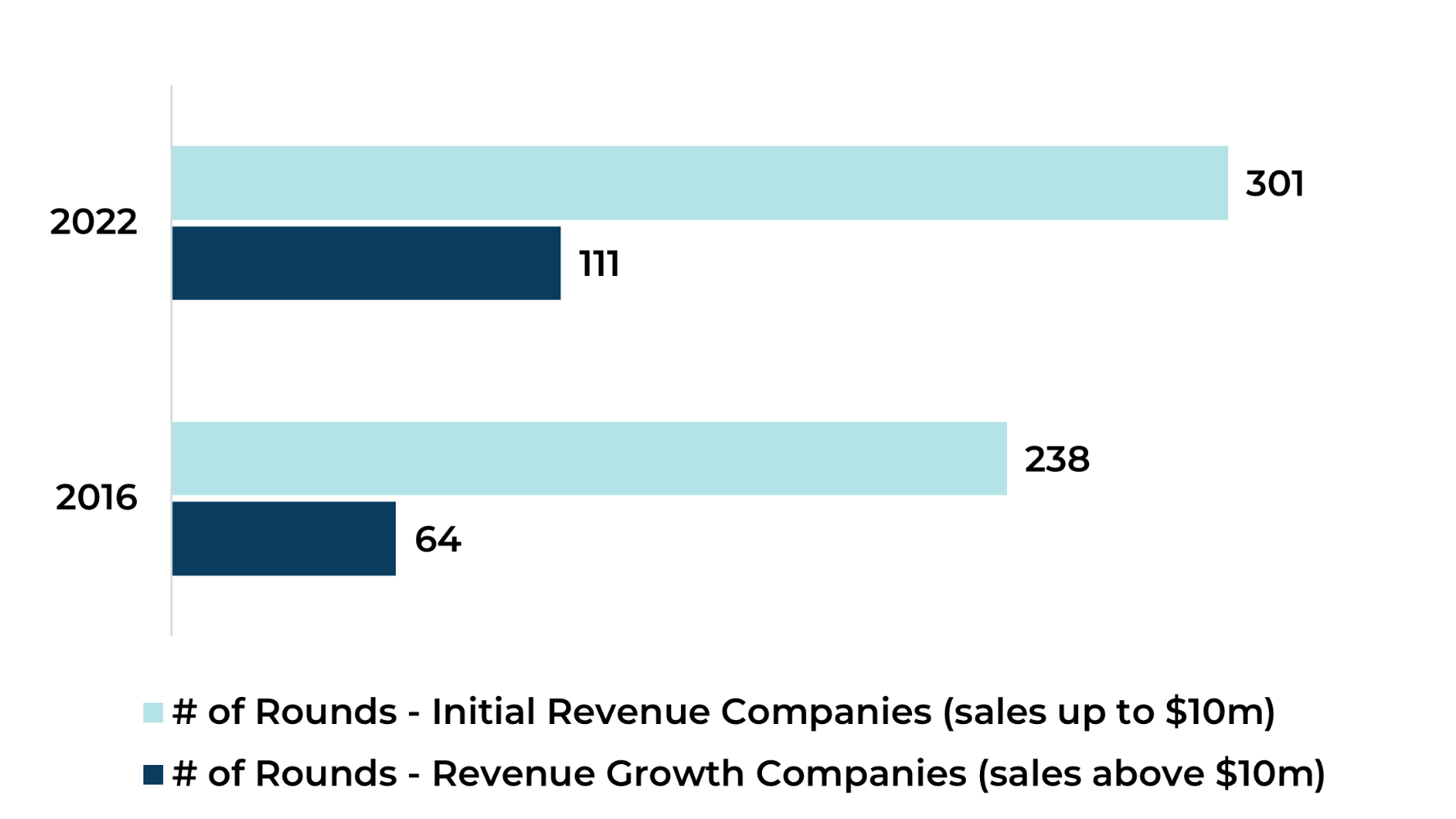

The number of funding rounds involving Mature Stage Companies (Companies with meaningful income) has increased in last years.

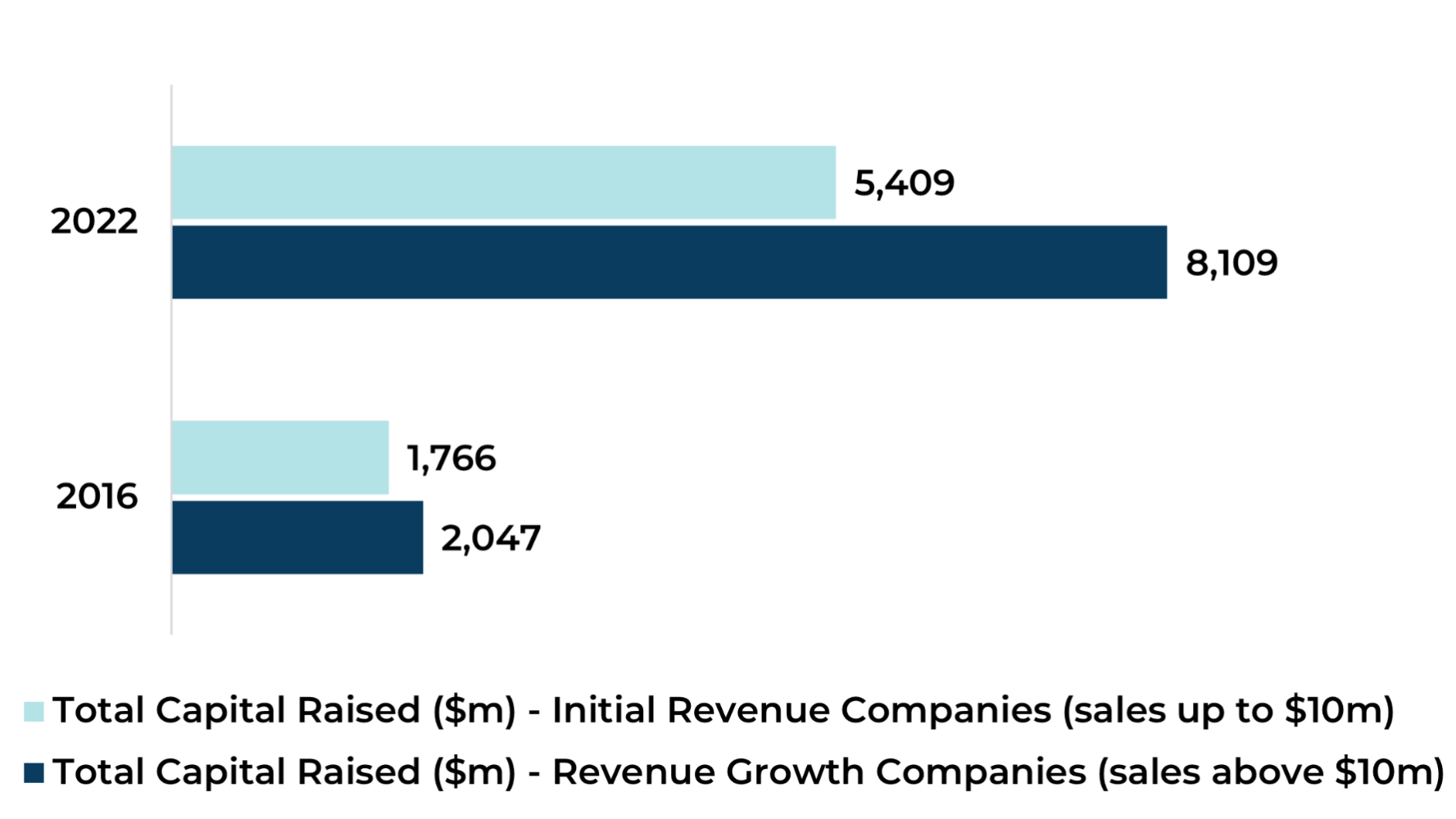

The amount of money invested in Revenue Growth companies in 2022 is more than 4 times higher than it was in 2016.

Israeli tech companies established between 2018-2022

Currently there are +9400 active tech companies on the IVC Database

looking at Israeli tech investments between 2018-2022, There is a significant increase in the amount of money raised by the companies with a peak marked by 2021, after which 2022 shows a decrease.

The number of funding rounds involving Mature Stage Companies (Companies with meaningful income) has increased in last years.

The amount of money invested in Revenue Growth companies in 2022 is more than 4 times higher than it was in 2016.

Entrepreneurial Culture

High quality startups, serial entrepreneurs, technology clusters, close proximity

Educated Human Resources

Skilled engineers, military service, elite

units, immigration (1991 Russia)

Strong Cooperation

Academic institutions, Government, Industry, Defense, Silicon Valley

Quality Academic Institutions

Research, scientists, 12 Nobel prize winners, IP-patents, Weitzman Institute, Technion

Modern Infrastructure

Legal, banking, financial, accounting, IP protection

Proven Exit Avenues

M&A is the main avenue, improved performance

Smart Money, Mainly Foreign

Food chain: VC funds, CVCs, PE Firms, Angel Investors, Incubators, Accelerators

Strong Presence of Multinationals

All sectors, regions, strategic – product needs, clients, DD, capital, exits

Commercialization

Defense-developed innovative technologies, basic science, academic research

Government Support

Israel Innovation Authority special programs: grants, incubators, human resources; tax incentives

Israel is only second to Silicon Valley in MNC's presence

Reaping the benefits of cutting-edge data and analysis has never been easier.

Enhance your decision-making process. Try us for free.